Mortgage Origination

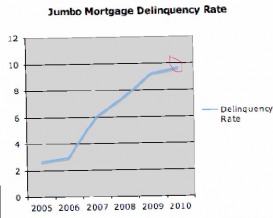

Jumbo Mortgages in Serious Delinquency

Source: Fitch Ratings

The delinquency rate on jumbo loans rose dramatically, tripling over the course of 2009. By February 2010, almost one in ten jumbo mortgages were "seriously delinquency". The graph shows U.S. prime jumbo mortgages at least 60 days late backing securities reached 9.6 percent in January from 9.2 percent in December. It is the 32nd straight increase for "serious delinquencies," according to Fitch Ratings.

Non-Conforming Nature

Although jumbo mortgages were not exotic as subprime and Alt-A, the reason why they got into such a huge trouble was because they are non-conforming so that they are not guaranteed by a government-backed mortgage agency, such as Fannie Mae or Freddie Mac. That means outside investors need to buy these loans in securitized bundles on the secondary market.

Secondary Market Dried Up

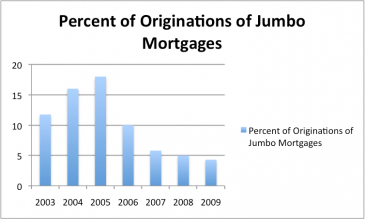

Source: CBMI Mortgage Data

When Wall Street loudly signaled its unwillingness to invest in these securities when subprime mortgage crisis emerged, lenders were afraid to loan such large amounts and investors who make these kinds of loans pulled their money back for safekeeping. The graph on the side shows the percentage of jumbo mortgage originations in previous years, as you can see, the number drop dramatically starting from 2005 when the sense of subprime crisis began to form.

Inability to Finance

Even Borrowers with good credit scores, good jobs and a down payment still can borrow, the interest rate would be high.

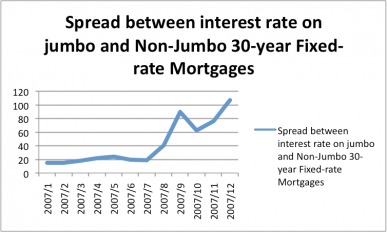

Source: UBS Mortgage Strategy Group

Jumbos have always had higher interest rates than conventional loans. Now with jumbo funding constricted, the spread has grown. As you can see in the picture, in 2007, the spread between jumbos and conventions had gone up from 20 to 80 basis point, which is 400% increase.

So the sales of high-priced homes came to a screeching halt because buyers could not get financing. it’s much more difficult to obtain financing for jumbo loans than it used to be.

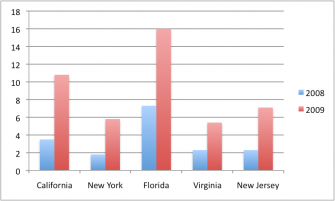

Source: CBS News

For those people who had jumbo loans, delinquency rates have been increasing. As you can graph, from 2008 to 2009 delinquency rates have gone up around 50% in all these areas where jumbo mortgages mostly obtained during recent years.

The video below was a interview taken a year ago when jumbo mortgages payments started to fall behind, Bloomberg editor Tom Keene was sharing his opinion about what caused the jumbo mortgage crisis.