Mortgage Origination

Subprime and ARM Mortgages

In various news outlets, the recent financial crisis has been dubbed "The Subprime Mortgage" crisis. Indeed, these mortgages are integral part of the crisis. An understanding of how and why, depsite the obvious risks that they pose, these mortgages were so widely and originated offers valuable insight into the nature of the financial crisis.

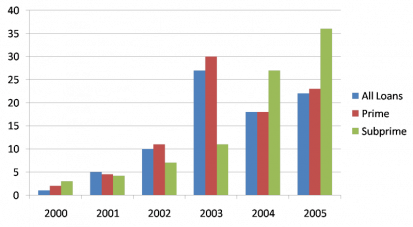

Number of Mortgages Outstanding (in Millions), by Year

NDS Origination year supplement

As evidenced by this graph, the period leading up to the crisis was marked by a rapid increase the amount of subprime loans. The primary reason for this incredible rise in mortgages is mainly attributed to Federal programs such as the Community Reinvestment Act pushed lenders to lower their mortgage lending requirements in order to increase home-ownership. This led to banks creating mortgages for unworthy borrowers that normally would not have received loans; this type of lending is know as subprime lending. Before these programs existed, loans usually went to "prime" borrowers who had worthy credit scores, demonstrable income, and a history of loan payments. Because of the pressures from these government programs, more and more loans went to subprime borrowers, who had poor credit scores, often times without provable income or neccessary identification. As a result, the number of these subprime mortgages skyrocketed.

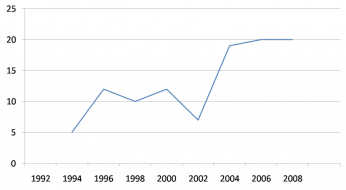

Subprime Mortgages as a Percentage of all Mortgages Outstanding

Edward Gramlich, FRB; Mara Lee, NPR

Following 2001, the percentage of these subprime borrowers receiving loans creeped slowly higher. By 2008, almost 1 in 5 mortgages outstanding were subprime mortgages. While Congress viewed this as a victory for home-ownership and the elimination of "redlining," these subprime mortgages were quietly creating an impending storm.

However, there were some candidates that were even ineligible or unable to receive even these subprime loans. To make it possible to create loans for these types of borrowers, banks utilized elements of Adjustable Rate Mortgages. These type of mortgages lured borrowers in with a low, "teaser," interest rate. After several years of the low interest rate, the interest rate would suddenly rise after three or four years, sometimes jumping from a 6-7% interest rate to as high as 20%. These types of mortgages were essentially designed to be impossible to pay once the interest rate rose. As a result, borrowers were forced to refinance their mortgages every time the interest rate rose for a fee to the bank.

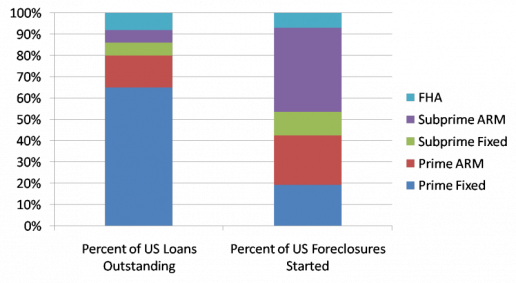

Type of U.S. Loans Outstanding vs. Foreclosure Rates, 2008

Mortgage Bankers Association Press Release – MBA National Delinquency Survey

Bank profits were high, home ownership was rising, and home prices seemed to be reaching higher and higher levels. Banks were creating a massive amount of loans and mortgages - the most dangerous of these being the "Subprime-ARM" mortgage. These mortgages utilized the elements of the Adjustable Rate Mortgages, but lent them to subprime borrowers. Instead of refinancing these ARMs, these type of borrowers (low income, low credit score) simply defaulted on these loans. As evidenced by graph, even though these subprime ARMs consisted a small portion of the all US loans outstanding, they contributed an overwhelming portion of the defaults and foreclosures that occurred in 2008.

Indeed, there was no regulatory oversight to prevent this massive subprime proliferation. The problem was made even worse due to the fact that banks were reaping massive profits from these types of mortgages. Banks could create a bunch of mortgages, then package them all together and sell them to Government Sponsored Entities such as Fannie Mae and Freddie Mac for a profit. This process of pooling these mortgages together to sell to investors is known as "securitization." As such, when borrowers began to default (to stop making payments) on these loans, both banks and owners of the "securtized" mortgages were forced to take massive losses.